Is It Worth Paying Higher Interest with Georgia hard money lenders?

Wiki Article

Understanding the Benefits and Dangers of Hard Cash Loans for Real Estate Investors

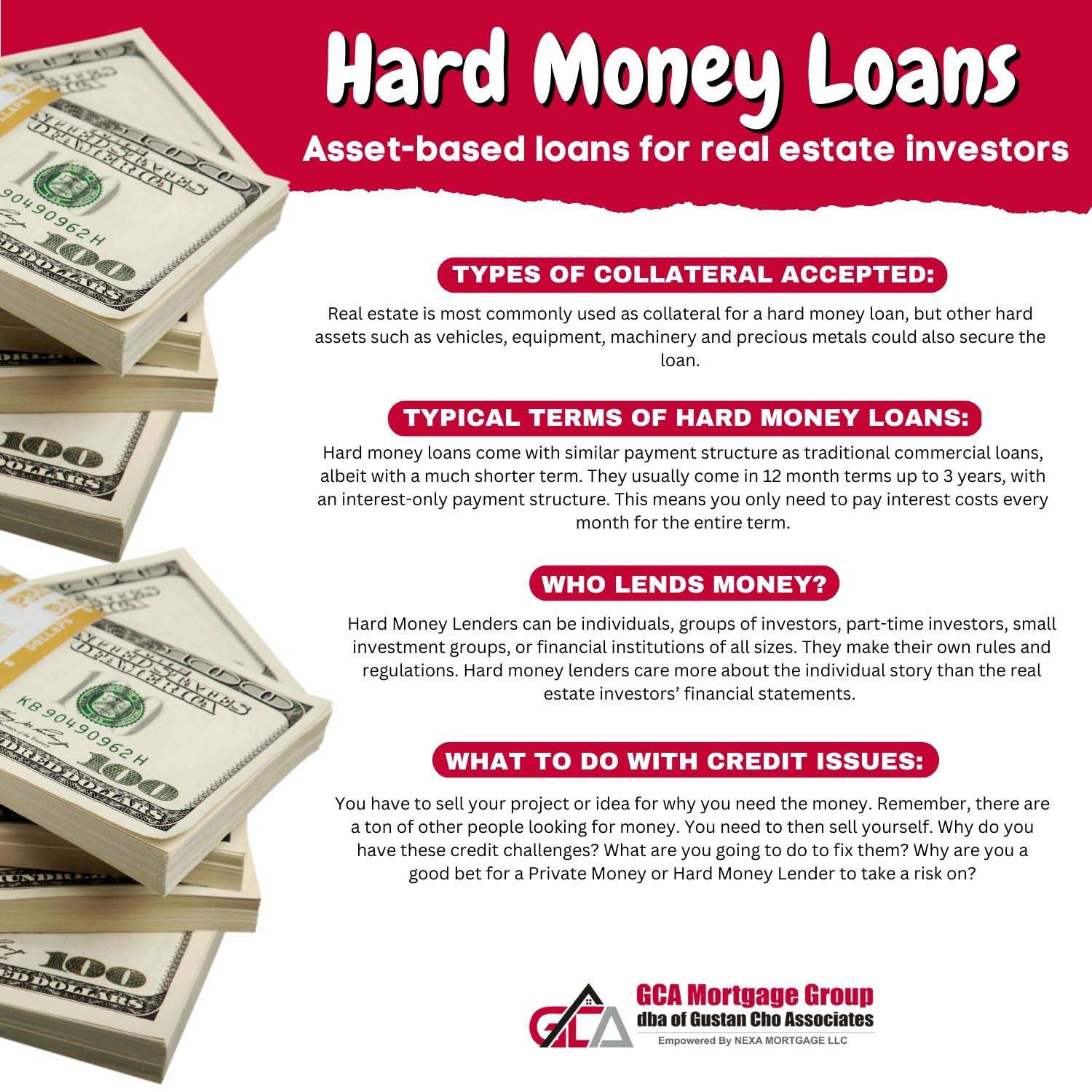

Difficult money fundings provide an one-of-a-kind financing choice for real estate financiers. They provide quick accessibility to funding with fewer limitations contrasted to traditional lendings. However, the allure of rate comes with substantial dangers, including high-interest rates and strict payment terms. Recognizing these characteristics is crucial for investors aiming to utilize on urgent opportunities. Steering through the benefits and potential challenges will determine whether tough cash car loans are a wise option for their financial investment method.What Are Difficult Money Financings?

Difficult cash lenders are usually private individuals or companies as opposed to standard banks, allowing them to run with more versatility concerning underwriting requirements. Rates of interest on tough money car loans tend to be higher compared to conventional financing, mirroring the increased risk included. Georgia hard money lenders. Financiers often turn to these lendings when they require fast access to funding for acquiring, renovating, or turning homes. Comprehending the nature of hard money financings is vital for financiers seeking to leverage opportunities in the property market

Key Perks of Hard Money Loans

Difficult money car loans use several advantages that attract investor. These fundings provide quick access to funds, making it possible for capitalists to take possibilities without prolonged approval procedures. In addition, flexible financing criteria and temporary funding services make them an appealing choice for various investment approaches.Quick Accessibility to Funds

Versatile Offering Standards

For genuine estate capitalists, adaptable lending standards stand for a substantial benefit of difficult cash fundings. Unlike typical funding options, which typically rely heavily on debt ratings and comprehensive documentation, difficult cash lenders concentrate primarily on the value of the residential property being financed. This strategy allows investors with less-than-perfect credit or restricted economic background to secure funding, making it much easier to seek investment opportunities. In addition, hard cash loan providers might also think about the financier's experience and the home's potential for gratitude instead than entirely assessing monetary metrics. This versatility can speed up the funding authorization process, making it possible for financiers to act swiftly in affordable realty markets. Such compassion in lending requirements is specifically helpful for those seeking to utilize on time-sensitive offers.Temporary Funding Solutions

Actual estate investors usually encounter time constraints, short-term funding services like hard cash loans provide a practical choice to satisfy instant financing needs - Georgia hard money lenders. These finances are typically protected by the residential property itself, allowing capitalists to bypass prolonged standard financing procedures. Authorization can commonly happen within days, making tough cash lendings optimal for time-sensitive transactions such as flipping homes or closing on troubled residential or commercial properties. The rate of funding enables investors to maximize profitable chances that may or else be missed out on. Furthermore, these lendings can be tailored to match particular job timelines, supplying versatility in payment terms. On the whole, difficult cash finances function as a necessary device for capitalists seeking quick access to capital in a competitive real estate marketProspective Disadvantages of Hard Money Loans

While hard cash finances provide quick accessibility to capital, they feature considerable disadvantages that financiers ought to think about. Particularly, high rate of interest rates can bring about substantial expenses in time, while short payment terms may pressure customers to generate quick returns. These aspects can influence the total feasibility of utilizing hard cash fundings genuine estate investments.High Rate Of Interest

What elements add to the high rate of interest usually associated with tough cash finances? Primarily, these prices reflect the risk profile that lending institutions take on. Tough cash finances are typically provided by exclusive capitalists or firms, which do not comply with typical financial regulations. Because of this, they typically money properties that conventional lenders may deem as well dangerous. Additionally, tough money car loans are usually short-term remedies, necessitating greater interest prices to make up for the rapid turn-around. The rate of financing also contributes; lenders charge more for the comfort and quick accessibility to capital. While difficult cash fundings can be valuable for quick deals, the high rate of interest rates can considerably influence total financial investment returns, making careful consideration necessary for prospective customers.Short Settlement Terms

High passion prices are not the only concern for borrowers thinking about hard cash financings; short payment terms additionally present considerable difficulties. Typically varying from a few months to a pair of years, these terms can press borrowers to generate quick returns on their financial investments. This urgency may bring about hasty decision-making, leading to less-than-optimal property acquisitions or insufficient restorations. Furthermore, the impending deadline can produce economic strain, as capitalists must either safeguard refinancing or sell the building within a tight duration. The risk of default rises under such conditions, possibly leading to loss of the security. Consequently, while difficult money fundings provide rapid access to funding, the brief repayment terms can make complex a financier's economic technique and total success.When to Consider Hard Money Car Loans

When is it sensible for real estate financiers to ponder hard cash financings? When conventional financing alternatives are impractical, such car loans are commonly considered. Financiers could seek difficult money car loans for quick access to resources, particularly in competitive property markets where timely offers are important. They are specifically useful in situations including troubled buildings, where immediate renovations are essential to increase worth. Additionally, when an investor's credit report background is much less than optimal, hard money financings offer an alternate route to funding. Financiers may also locate these lendings valuable for obtaining properties at public auctions, where immediate financing is needed. Additionally, for those looking to leverage temporary investments or fix-and-flip chances, tough money lendings can assist in swift deals. Ultimately, the decision to use hard money car loans ought to be assisted by the details financial investment technique and time-sensitive demands of the capitalist.

Just how to Pick the Right Hard Cash Lending Institution

Selecting the appropriate difficult cash lender is essential genuine estate capitalists that choose to pursue this financing choice. Financiers should start by researching lending institutions' evaluations and credibilities to ensure integrity. It is crucial to verify the loan provider's experience in the property market, specifically in the specific kind of investment being targeted. Examining car loan terms, consisting of rates of interest, costs, and repayment schedules, enables financiers to contrast offers successfully. Transparency in interaction is essential; a great lender should conveniently address questions and provide clear explanations of the finance procedure. In addition, reviewing the loan provider's funding rate can influence investment chances, as prompt accessibility to capital is usually crucial. Developing a connection with a lending institution can facilitate future transactions, making it useful to choose a lending institution that is not just expert yet additionally recognizes the investor's objectives and needs. Demands Methods for Effective Difficult Cash Finance Investment Efficiently steering hard cash car loan investments needs a tactical technique that maximizes returns while minimizing threats. Financiers should start by conducting comprehensive marketing research, determining locations with strong growth possibility and targeting homes that can generate high returns. Establishing a clear departure method link is crucial, whether via home resale or refinancing.In addition, maintaining a strong connection with reputable difficult cash lenders can assist in smoother transactions and far better terms. Investors need to likewise carry out thorough due persistance on residential or commercial properties, examining their condition and prospective fixing prices to stay clear of unexpected expenditures.

Networking with experienced financiers can give understandings right into effective financial investment techniques and mistakes to avoid. A mindful evaluation of the car loan's terms, including rate of interest prices and payment timetables, is necessary to guarantee the investment remains profitable. By executing these methods, capitalists can navigate the complexities of difficult cash financings effectively and enhance their total success in property investing.

Often Asked Concerns

What Sorts Of Residence Get Approved For Hard Money Loans?

Difficult money car loans commonly qualify buildings that require fast funding, such as fix-and-flips, business structures, and financial investment residential or commercial properties. Lenders largely consider the residential property's worth instead than the debtor's credit reliability or earnings.Just How Quickly Can I Receive Funds From a Difficult Cash Lender?

The speed of getting funds from a tough cash loan provider normally varies from a couple of days to a week. Georgia hard money lenders. Aspects affecting this duration include residential or commercial property appraisal, paperwork efficiency, and the lender's operational performanceAre Difficult Money Lendings Available for Non-Investment Residence?

Hard money lendings are mostly made for investment homes, but some lenders might take into consideration non-investment buildings under certain scenarios. Borrowers ought to make inquiries straight with lenders to recognize particular qualification requirements and problems.What Fees Are Usually Related To Difficult Money Fundings?

Difficult cash financings usually include numerous fees, including source charges, evaluation costs, shutting costs, and often prepayment charges. These costs can considerably influence the overall price, necessitating cautious factor to consider by prospective debtors.

Can I Refinance a Tough Money Finance In The Future?

The opportunity of refinancing a difficult cash finance exists, normally subject to the residential property's gratitude and borrower certifications. This procedure might help with reduced rates of interest or better terms, boosting financial flexibility for the financier.Tough money loans offer a distinct funding option for real estate financiers. Hard cash financings are specialized funding alternatives mainly made use of by genuine estate investors. Protecting quick accessibility to funds is a main benefit view for genuine estate resource investors seeking tough cash loans. Real estate capitalists usually face time restrictions, short-term financing solutions like difficult cash fundings offer a sensible alternative to meet instant funding demands. Financiers may look for hard cash lendings for fast access to funding, specifically in competitive real estate markets where timely offers are necessary.

Report this wiki page